What We Do

At Operational Tax Consulting Services, we empower our clients' organizations to foster collaborative thinking across their business, driving workplace innovation by connecting people, processes, data, and technology. We believe the Indirect tax function can be transformative, evolving from its traditional role of reporting results to becoming a value-added entity aligned with the Finance Team's overall goals and the enterprise's objectives.

We leverage our experience in corporate tax, public accounting, and government to provide our clients with a holistic view of their indirect tax landscape. Our goal is to help add value across your business enterprise as it relates to your transaction tax needs. Spend less time in compliance and more time on value-added enterprise functions that empower your tax professionals.

Tax Software Supported

- Avalara

- Sovos

- Thomson Reuters – One Source Indirect Tax

- Vertex

- Other

Software Platforms

- Amazon

- BigCommerce

- Chargebee

- DoorDash / Grubhub / Instacart, etc.

- Magento

- Maximo

- Shopify / Shopify+

- Stripe

- Walmart

- Other

ERP’s & Financial Software

- Acumatica

- Epicor

- Microsoft BC

- Microsoft D365 FSC

- NetSuite

- Oracle Cloud

- SAP

- Sage Intacct

- Salesforce

- QuickBooks (Online and Desktop)

- Other

Who We Work With

Internal Accounting Functions

- Accounts Receivable

- Billing

- Credit Team

- Master Data

- Accounts Payable

- Purchasing / Procurement

- Legal

- IT

- C-Suite

External Partners

- Tax Software Partners

- Accounting Partners

- ERP Implementation Partners

Tax Software Services

Service options for your indirect tax software needs.

Tax Engine Health Check

A review of your third-party tax engine and recommendations for efficiencies.

Returns Health Check

An assessment of your tax return configuration as it relates to your current tax calendar filing obligations with actionable recommendations.

Tax Engine Training

Ensuring your team is equipped with tailored tax engine training for continued maintenance and future growth.

Tax Data Migration

Migrating your historical tax data for robust reporting and audit trail.

Tax Engine Managed Service

Monthly, Quarterly, and/or Annual review of your third-party tax engine configuration to suit your business needs.

Third-Party Tax Software Implementation

Implement third-party tax engine to integrate with your customer billing/order and vendor payable processes.

Product/Service Taxability Mapping

Map third-party tax codes to your products and/or services that allows for correct tax determinations to be made on a state-by-state basis.

Tax Software Selection

Assess and evaluate your business processes and provide guidance to select the right tax software to scale your business.

Exemption Certificate Management

Comprehensive certificate services including analysis, consultation, and certificate migration.

Tax Advisory Services

Expert guidance to navigate the complexities of indirect taxation.

Tax Process Optimization

Advisory services for day-to-day indirect tax function management.

Nexus Review & Entity Analysis

Review of physical and economic nexus on a state-by-state basis for proper registration and sales tax compliance.

Sales Tax Compliance

Sales and use tax return preparation and review.

Taxability Research

Provide research and analysis for your products and/or services on a state-by-state basis.

Audit Defense

Comprehensive support for audit preparation, representation, and post-audit risk mitigation.

Due Diligence

Reduce indirect tax exposure that allows you to maximize transactional return and reduces funds held in escrow OR reduce the purchase price to properly reflect transaction value.

Our Approach

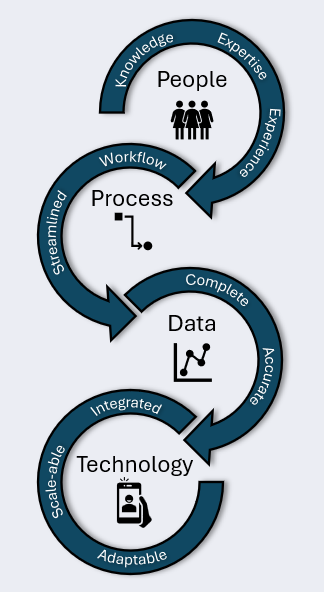

Implementing technology without considering the holistic approach that involves your people, process, and data, leads to a poor implementation result. At OTC Services, we believe the tax role is proactive, goal driven, and results oriented, ensuring tax is a strategic function representative of the overall business.

OTC Services ensures the following deliverables:

Our Team

Our team excels in transforming complex tax challenges into streamlined solutions. Specializing in innovative indirect tax software integration, we're committed to optimizing business processes and enhancing value through strategic tax advisory services. Our united passion for excellence ensures tailored support for businesses navigating the intricacies of indirect taxes.

Joe Malloy

Joe leverages his government, corporate finance/tax, and public accounting state and local tax experience to optimize business earnings and deliver value and results through the tax function. Joe has been the leader of the indirect tax automation practice for an international public accounting firm, served as State and Local tax director for a multi-billion-dollar printing and marketing firm, and was the leader of the sales and use tax function for a national retailer. His specific experience includes tax planning, business process review, software integration, business partnering, tax compliance, M&A integration, and managing tax controversies. In his role, Joe is responsible for strategic planning and alignment throughout the organization by implementing GMW’s goals, targets, and objectives.

LinkedinLet's Chat!

We're excited to hear about your business and explore how OTC Services can contribute to your success. Drop us a message – we're all about building connections and finding great solutions together!